New Report on the Livelihoods of Tobacco and Former Tobacco Farmers Amidst Fierce Public Debates on Tobacco Taxes

Tobacco taxation is proven to be one of the most effective tobacco control policies. A significant increase in tobacco excise taxes typically increases tobacco prices, leading to decreases in tobacco consumption. Indonesia has recently made some advances in tobacco tax policy, while there remains significant room for improvement. The 2nd edition of the Tobacconomics Cigarette Tax Scorecard shows that Indonesia made some improvement between 2018 and 2020, including increases in cigarette prices, reduction of cigarette affordability, and an increase in the tax share of price, though some of the improvement in affordability was the result of economic decline at the beginning of the COVID-19 pandemic. The initial momentum of a good-sized excise tax increase was lost in 2021, when the Ministry of Finance reduced the increase to an average of 12.5%, which is not sufficient to stay ahead of inflation and economic growth. Importantly, there were no advances in efforts to reform the complex multi-tiered tax structure, which hinders the effectiveness of the tobacco excise tax policy, because it gives smokers many opportunities to “trade down” to cheaper products. Read More

Cigarette Tax Scorecard (2nd edition): Modest Progress on Cigarette Taxes Should be Scaled Up

The second edition of the Tobacconomics Cigarette Tax Scorecard is out today and shows that governments have made insufficient progress in addressing the world’s leading cause of preventable death, even though the most effective tool—tobacco taxation—would reduce smoking and increase revenues. Read More

The Intersection of Tobacco Taxes and Tobacco Farming in Indonesia

Last month (December 2020), Indonesia’s finance minister announced a small increase in tobacco excise taxes—approximately 12.5% on average. Though the public health community typically welcomes any tax increase, to have a meaningful effect on tobacco prices and therefore consumption, increases must be larger than the ones proposed. To make tobacco taxation more effective, not only do increases need to be larger, there also needs to be an increased effort to simplify the tax structure as regulated on the now eliminated Excise Simplification Roadmap. The tiered structure with very different tax rates among cigarette and kretek products continues to generate opportunities for smokers to “trade down”—i.e., switching to cheaper kretek or cigarette brands. Read More

[BAHASA] Irisan antara Kebijakan Cukai Rokok dan Pertanian Tembakau di Indonesia

Pada bulan Desember 2020, Menteri Keuangan Republik Indonesia mengumumkan kenaikan tarif cukai rokok yang tidak terlalu signifikan yaitu dengan rerata sekitar 12,5 persen. Secara umum, pemangku kepentingan kesehatan publik memberi apresiasi atas kenaikan tarif cukai rokok ini. Namun, kenaikan tarif cukai rokok hanya akan berdampak pada harga rokok dan akhirnya konsumsi jika kenaikannya lebih tinggi dari yang telah diumumkan. Agar kenaikan tarif cukai rokok lebih efektif, tidak hanya kenaikannya harus lebih tinggi, pemerintah Indonesia juga perlu mengupayakan penyederhanaan struktur cukai seperti yang pernah dituangkan dalam Peta Jalan Simplifikasi Cukai Rokok, yang saat ini telah dihilangkan. Struktur cukai rokok dengan tarif cukai rokok yang berjenjang antar produk rokok memberikan ruang kepada perokok untuk beralih ke produk rokok yang lebih murah. Respon perilaku terhadap kenaikan cukai rokok berpotensi mengurangi dampak dari kenaikan cukai rokok terhadap pengurangan konsumsi. Read More

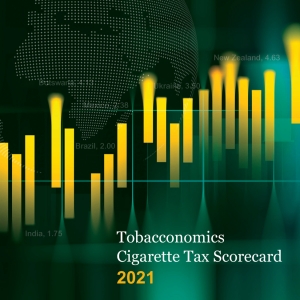

Interview: Dr. Frank Chaloupka Explains India's Score in the Tobacconomics Cigarette Tax Scorecard

Dr. Frank Chaloupka was interviewed by Swapna Raghu Sanand from Financial Express on January 13, 2021. He discusses India's low score in the Tobacconomics Cigarette Tax Scorecard and provides concrete steps for the government to improve the country's cigarette tax policies. Read More